QuidelOrtho Stock Rises as Q3 Earnings & Revenues Beat Estimates

Werte in diesem Artikel

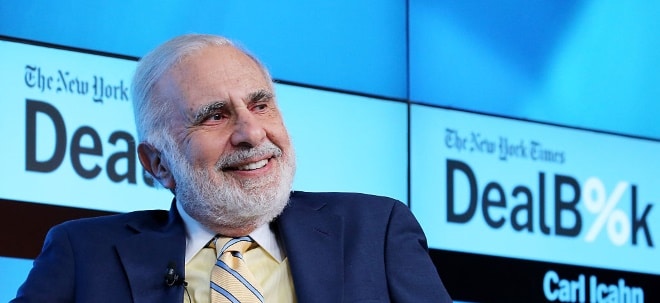

QuidelOrtho Corporation QDEL reported an adjusted earnings per share (EPS) of 85 cents in the third quarter of 2024compared with 90 cents in the year-ago period. The figure beat the Zacks Consensus Estimate by 172.4%.The adjustments include expenses related to the amortization of intangibles, and acquisition and integration costs, among others.GAAP loss per share in the quarter was 30 cents compared with 19 cents in the year-ago quarter.Revenues in DetailQuidelOrtho registered revenues of $727.1 million in the third quarter, which decreased 2.3% year over year on a reported basis and 1.8% at a constant exchange rate (CER). However, the figure beat the Zacks Consensus Estimate by 12.8%.In the third quarter, QuidelOrtho’s total recurring revenues, excluding COVID-19-related revenues, instrument revenues and U.S. Donor screening revenues, were $597.9 million (up 0.4% on a reported basis and 0.9% at CER). The company defines recurring revenue as revenues from sales of assays, reagents, consumables and services, excluding instruments.In the third quarter, Respiratory revenues were $165.4 million (down 10.8%, both on a reported basis and at CER).Non-Respiratory revenues were $561.7 million (up 0.6% on a reported basis and 1.2% at CER).Segments in DetailQuidelOrtho now derives revenues from five business units — Labs, Immunohematology, Donor Screening, Point-Of-Care (POC) and Molecular Diagnostics (MDx). The company started reporting Transfusion Medicine business unit results under two separate business units — Immunohematology and Donor Screening — in the third quarter. The company started separate reporting items to provide greater transparency to the impact of winding down of the U.S. Donor Screening business by the end of 2025In the third quarter, Labs revenues were $355.9 million, up 4.2% and 5.2% on a reported basis and at CER, respectively.Immunohematology revenues were $132 million in the third quarter, up 2.4% on a reported basis and 3.1% at CER. Donor Screening revenues totaled $28 million in the third quarter, down 20% on a reported basis as well as at CER.POC revenues amounted to $205.6 million in the third quarter, reflecting a decline of 11.8% and 11.9% on a reported basis and at CER, respectively.MDx revenues totaled $5.6 million in the third quarter, flat on a reported basis and down 0.6% at CER.Geographical DistributionGeographically, QuidelOrtho derives revenues from North America, Europe, the Middle East and Africa (EMEA), China and Other regions (which includes Latin America, Japan and other Asia-Pacific markets).Revenues from North America amounted to $436.2 million, reflecting a decline of 6.2% and 6.5% on a reported basis and at CER, respectively.EMEA revenues amounted to $84 million, reflecting an uptick of 12.8% and 11.8% on a reported basis and at CER, respectively.Revenues from China amounted to $80.4 million, reflecting a decline of 0.9% on a reported basis and 1.2% at CER.Revenues from Other regions amounted to $126.5 million, reflecting an improvement of 2.7% on a reported basis and 8% at CER.QuidelOrtho Corporation Price, Consensus and EPS Surprise QuidelOrtho Corporation price-consensus-eps-surprise-chart | QuidelOrtho Corporation QuoteMargin TrendIn the quarter under review, QuidelOrtho’s adjusted gross profit declined 4.9% to $357.4 million. The adjusted gross margin contracted 130 basis points (bps) to 49.2%.Selling, marketing and administrative expenses decreased 3.9% year over year to $186.4 million. Research and development expenses declined 9.1% year over year to $55.9 million. Operating expenses amounted to $242.3 million, down 5.2% year over year.Operating income totaled $15 million compared with $26.3 million in the prior-year quarter.Financial PositionQuidelOrtho exited third-quarter 2024 with cash and cash equivalents of $143.7 million compared with $107 million at the end of the second quarter. Total debt (including short-term debt) at the end of third-quarter 2024 was $2.55 billion compared with $2.56 billion at the second-quarter end.Cumulative net cash provided by operating activities at the end of third-quarter 2024 was $19.3 million compared with $199.8 million a year ago.2024 Guidance UpdateQDEL reinstated its full-year 2024 outlook on earnings and revenues.The company expects full-year 2024 total reported revenues between $2.75 and $2.80 billion. The Zacks Consensus Estimate for the same is pegged at $2.72 billion.QDEL expects full-year 2024 earnings in the range of $1.69-$1.91. The Zacks Consensus Estimate for the same is pinned at $1.75 billion.Our TakeQuidelOrtho’s earnings and revenues beat the Zacks Consensus Estimate in the third quarter of 2024. The company witnessed growth in its recurring revenues. Strong revenue growth in the EMEA and Japan, Asia-Pacific and Latin America regions buoys optimism.Shares were up 6.4% during pre-market trading following the third-quarter results. However, the stock plunged 47.2% year to date against the industry’s 13.7% growth and the S&P 500’s 24.8% increase.Per the third-quarter earnings call, the respiratory business performed well during the quarter, with a strong performance from Sofia flu and COVID-19 combo test.In August, QDEL announced the FDA 510(k) clearance for its VITROS syphilis assay part of its menu, which is likely to strengthen its position as a leader in infectious disease testing. The expansion into the U.S. market aims to provide timely and accurate diagnosis, which is crucial for effective treatment and control of the disease.However, revenue decline in the North American region was discouraging.Image Source: Zacks Investment ResearchQDEL’s Zacks Rank and Key PicksQuidelOrtho currently carries a Zacks Rank #4 (Sell).Some better-ranked stocks in the broader medical space are AngioDynamics ANGO, Quest Diagnostics DGX and RadNet RDNT. Each stock presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.ANGO’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 31.71%.AngioDynamics’ shares have lost 19.2% year to date against the industry’s6.1% growth.Quest Diagnostics has an estimated long-term growth rate of 6.8%. DGX's earnings surpassed estimates in each of the trailing four quarters, with the average being 3.3%.Quest Diagnostics has gained 42% year to date compared with the industry's 14.9% rise.RadNet’s earnings surpassed estimates in the trailing four quarters, the average surprise being 98.2%.RDNT shares have surged 93.7% year to date compared with the industry’s 14.8% rally.Free: 5 Stocks to Buy As Infrastructure Spending SoarsTrillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report AngioDynamics, Inc. (ANGO): Free Stock Analysis Report Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report QuidelOrtho Corporation (QDEL): Free Stock Analysis Report RadNet, Inc. (RDNT): Free Stock Analysis ReportTo read this article on Zacks.com click here.Zacks Investment ResearchWeiter zum vollständigen Artikel bei Zacks

Ausgewählte Hebelprodukte auf QuidelOrtho

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf QuidelOrtho

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Quelle: Zacks

Nachrichten zu QuidelOrtho Corporation Registered Shs

Analysen zu QuidelOrtho Corporation Registered Shs

Keine Analysen gefunden.