HORIZON PETROLEUM ANNOUNCES FINAL SIGNATURE OF THE BIELSKO-BIALA AND CIESZYN CONCESSIONS IN SOUTHWEST POLAND

CALGARY, AB, Nov. 21, 2024 /CNW/ - Horizon Petroleum Ltd. (TSXV: HPL).

Horizon Petroleum Ltd. ("Horizon" or the "Company") is pleased to announce that its wholly owned Polish subsidiaries have received the final, signed concession agreements for a 100% working interest in the Bielsko-Biala and Cieszyn concessions located in southwest Poland. In connection with the signed concession agreements the Company has also entered into an amendment agreement with San Leon Energy plc ("San Leon") to amend the payment date for the final consideration payable to San Leon to on or before April 30, 2025.

The completion of these steps satisfies the remaining conditions for graduation of the Company from the NEX to the TSX Venture Exchange as a Tier 2 Oil and Gas Issuer. The Company expects to complete this graduation process next week.

David Winter, CEO commented "We are pleased that the signing of the concessions has now taken place and that we can now prepare to commence operations. Importantly the Company can now book the independently evaluated probable reserves and 2C contingent resource values contained in the Lachowice gas development project which together exceed 200 bcf and have a Net Asset Value (discounted at 10%) that exceeds US$ 450 million (CAD $ 631 million). To prepare for the start of operations, the Company has also held consultation meetings with local communities and local authorities regarding the development of the Lachowice gas field. The development has been very well received locally and the communities and authorities are supportive of the Company's development plans. Furthermore, Horizon has also commenced preliminary, preparatory operations at the Lachowice-7 well location in readiness for a well re-entry planned for Q3 2025 to establish first gas production from the initial stage of development. I would like to thank all shareholders and stakeholders for their support and patience during this long process. Our team now look forward to getting on with the work to demonstrate and realize the exciting potential value associated with the Lachowice gas development."

Upon such graduation a total of 8,609,409 subscription receipts of the Company will convert to Units resulting in cash proceeds of $947,035 being available to the Company. The Subscription Receipts will be convertible into one Common Share and one Common Share purchase warrant of the Company (a "Subscription Receipt Warrant") which will be exercisable for a period of four years from closing at a price of CAD$0.30 per Common Share. The underlying securities are subject to a four month hold period from the original date of issue of the Subscription Receipts.

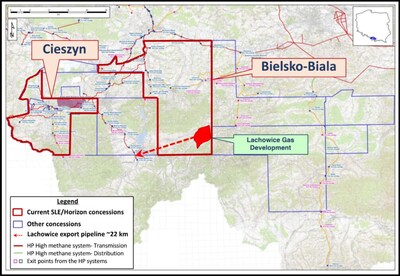

Overview of Horizon Petroleum's Polish Licences.

The Bielsko-Biala and Cieszyn concessions are located in southwest Poland and comprise 1,130 square kilometers.

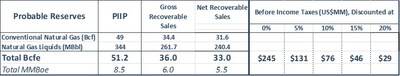

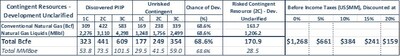

Apex Global Engineering Inc. ("Apex") was engaged to provide an NI51-101 compliant independent evaluation of reserves and contingent resources in the Lachowice gas development project located in the Bielsko-Biala concession.

The Reserve and Resource Report is dated effective December 31, 2023. The reserves and resource data summarize the natural gas liquids and natural gas reserves and contingent resources; and the before tax net present values of future net revenue for these reserves and contingent resources reflecting Horizon's 100% working interest using forecast prices and costs as stated in the report and summarized below. The Reserve and Resource Report has been prepared in accordance with the standards contained in the COGE Handbook and the reserve definitions contained in NI 51-101 and the COGE Handbook.

The Reserve Report is based on certain factual data supplied by the Company and, in the opinion of Apex, is within acceptable tolerances consistent with industry experience and practice. The extent and character of ownership and all factual data pertaining to the Company's two Polish properties and contracts were supplied by Horizon Petroleum to Apex.

There are numerous uncertainties inherent in estimating quantities of crude oil, natural gas and NGL reserves and resources and the future cash flows attributed to such reserves/resources . The reserves/resources and associated cash flow information set forth in this prospectus are estimates only. In general, estimates of economically recoverable oil and natural gas reserves and the future net cash flows there from are based upon a number of variable factors and assumptions, such as historical production from the properties, test production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially from actual results. For those reasons, estimates of the economically recoverable natural gas liquids and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary. The Company's actual production, revenues, taxes and development and operating expenditures with respect to its reserves will vary from estimates thereof and such variations could be material. It should not be assumed that the undiscounted or discounted net present value of future net revenue attributable to reserves estimated by Apex represent the fair market value of those reserves.

The information relating to the Company's natural gas liquids and natural gas reserves contains forward- looking statements relating to future net revenues, forecast capital expenditures, future development plans and costs related thereto, forecast operating costs, anticipated production and abandonment and reclamation costs.

Pricing Assumptions

The forecast cost and price assumptions above assume changes in future wellhead commodity prices and take into account inflation with respect to future operating and capital costs. The following natural gas liquids (condensate), natural gas and electricity benchmark reference pricing, inflation and exchange rates were utilized in the Reserve Report.

YEAR | Natural | Natural | Gas | Net Gas | Condensate | Electricity | Electricity |

$US/MMbtu | % | $US/Mcf | $US/Mcf | $US/bbl | $US/MWh | $US/MMbtu | |

2024 | 15.75 | 109 | 1.00 | 16.17 | 80.00 | 97.50 | 7.02 |

2025 | 12.75 | 109 | 1.00 | 12.90 | 80.00 | 112.50 | 8.10 |

2026 | 11.75 | 109 | 1.00 | 11.81 | 80.00 | 125.00 | 9.00 |

2027 | 10.50 | 109 | 1.00 | 10.45 | 81.60 | 127.50 | 9.18 |

2028 | 9.50 | 109 | 1.00 | 9.36 | 83.23 | 130.05 | 9.36 |

2029 | 9.00 | 109 | 1.00 | 8.81 | 84.90 | 132.65 | 9.55 |

2030 | 9.00 | 109 | 1.00 | 8.81 | 86.59 | 135.30 | 9.74 |

2031 | 9.18 | 109 | 1.00 | 9.01 | 88.33 | 138.01 | 9.94 |

2032 | 9.36 | 109 | 1.00 | 9.21 | 90.09 | 140.77 | 10.14 |

2033 | 9.55 | 109 | 1.00 | 9.41 | 91.89 | 143.59 | 10.34 |

*The Heating Modifier recognizes the higher heating value of the gas as it includes the ethane and butane | |||||||

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains "forward-looking statements" or "forward-looking information" (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Such forward-looking statements include, without limitation, forecasts, estimates, expectations and objectives for future operations that are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Horizon. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur or be achieved. This press release contains forward-looking statements pertaining to, among other things entering into the Concessions and completion of the transformation process and the furtherance of Horizon's European acquisition and development strategy. There is no assurance the Concession will be granted or the transformation process will be completed.

Forward-looking information is based on current expectations, estimates and projections that involve a number of risks, which could cause actual results to vary and in some instances to differ materially from those anticipated by Horizon and described in the forward-looking information contained in this press release.

Although Horizon believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements were made, no assurances can be given as to future results, levels of activity and achievements and such statements are not guarantees of future performance.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/horizon-petroleum-announces-final-signature-of-the-bielsko-biala-and-cieszyn-concessions-in-southwest-poland-302312457.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/horizon-petroleum-announces-final-signature-of-the-bielsko-biala-and-cieszyn-concessions-in-southwest-poland-302312457.html

SOURCE Horizon Petroleum Ltd.