Less-than-Truckload (LTL) Market to grow by USD 120.31 Billion (2024-2028), driven by e-commerce advances, Report on AI's impact on redefining market landscape - Technavio

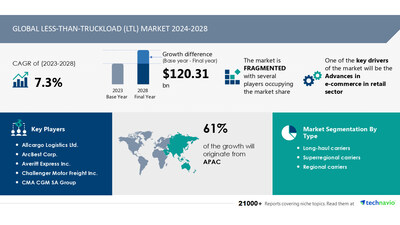

NEW YORK, Dec. 15, 2024 /PRNewswire/ -- Report with market evolution powered by AI - The global less-than-truckload (LTL) market size is estimated to grow by USD 120.31 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 7.3% during the forecast period. Advances in e-commerce in retail sector is driving market growth, with a trend towards emergence of big data in global less-than-truckload (LTL) market. However, rising prices of ltl carriers poses a challenge. Key market players include Allcargo Logistics Ltd., ArcBest Corp., Averitt Express Inc., Challenger Motor Freight Inc., CMA CGM SA Group, Debon Logistics Co. Ltd., Deutsche Post AG, Estes Express Lines, FedEx Corp., J B Hunt Transport Services Inc., JRC Dedicated Services Co., Knight Swift Transportation Holdings Inc., Kuehne Nagel Management AG, Nippon Express Holdings Inc., Old Dominion Freight Line Inc., R L Carriers Inc., SouthEastern Freight Lines, United Parcel Service Inc., XPO Inc., and Yellow Corp..

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View Free Sample Report PDF

Forecast period | 2024-2028 |

Base Year | 2023 |

Historic Data | 2018 - 2022 |

Segment Covered | Type (Long-haul carriers, Superregional carriers, and Regional carriers), Capacity (Light LTL volume and Heavy LTL volume), and Geography (APAC, North America, Europe, Middle East and Africa, and South America) |

Region Covered | APAC, North America, Europe, Middle East and Africa, and South America |

Key companies profiled | Allcargo Logistics Ltd., ArcBest Corp., Averitt Express Inc., Challenger Motor Freight Inc., CMA CGM SA Group, Debon Logistics Co. Ltd., Deutsche Post AG, Estes Express Lines, FedEx Corp., J B Hunt Transport Services Inc., JRC Dedicated Services Co., Knight Swift Transportation Holdings Inc., Kuehne Nagel Management AG, Nippon Express Holdings Inc., Old Dominion Freight Line Inc., R L Carriers Inc., SouthEastern Freight Lines, United Parcel Service Inc., XPO Inc., and Yellow Corp. |

Key Market Trends Fueling Growth

Less-than-truckload (LTL) logistics companies and shippers are utilizing big data to gain a competitive edge in the industry. Big data analysis offers advantages in operational efficiency, customer experience, and new business models. In terms of operational efficiency, LTL companies can optimize resource utilization, delivery time, and geographical coverage through advanced real-time processing and predictive techniques. Customer experience is enhanced by analyzing millions of touchpoints to gain market intelligence and product feedback. By sharing data with supply chain partners, logistics networks can become more efficient, leading to the development of new services, discovery of new demand patterns, and improved demand forecasting accuracy. Real-time analytics and end-to-end supply chain visibility enable quick action on potential revenue losses and increased asset uptime. The integration of big data solutions will positively impact the growth of the global LTL market by increasing throughput, enabling resource optimization, and facilitating near real-time supply planning using IoT data feeds.

The Less-than-Truckload (LTL) market is experiencing significant trends in freight transportation. With increasing demand for oil, petrol, and diesel from truckers, oil marketing companies are playing a crucial role. LTL services offer scalability and affordability for shippers with small to medium-sized cargo. Trailer capacity is a key factor, with density-based pricing and operational efficiency driving competition among freight carriers. Economic conditions and industry sectors, such as retail, manufacturing, agriculture, fishing, forestry, construction, oil and gas, mining, and quarrying, influence LTL freight volume. Startups and specialized carriers are disrupting the market with flexible services. E-commerce and MSME sector growth fuel retail shipping demand. Freight pricing trends include volume-based pricing and fuel surcharges. Full Truckload carriers and ground shipping dominate, but air, rail, and specialized services cater to specific needs. Full Truckload carriers offer larger capacity, while LTL services provide flexibility for various industries. Road freight services remain a significant part of the logistics sector.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

Market Challenges

- The Less-than-truckload (LTL) market is currently facing several challenges that are driving up costs and intensifying competition. Rising fuel prices, increasing demand, e-commerce growth, driver shortages, and tightening truckload capacity are all contributing factors. LTL carriers are investing heavily in their fleets, drivers, and facilities to stay competitive, but face risks associated with fuel pricing volatility. Last-mile delivery, which involves individual deliveries to numerous locations, adds significant labor and fuel costs. Intense competition among last-mile delivery providers, based on pricing and delivery time, further pressures profitability. Additionally, real-time tracking requirements for e-commerce deliveries necessitate costly geolocation technologies and infrastructure. These factors are leading LTL carriers to increase freight rates, which may constrain market growth during the forecast period.

- The Less-than-Truckload (LTL) market faces several challenges. Truckers struggle with oil demand fluctuations, affecting petrol and diesel prices for freight transportation. Oil marketing companies' crude oil prices impact freight carriers' operational efficiency and affordability. Shippers require scalability and flexibility, especially for small and medium shipments in various industries like retail, manufacturing, agriculture, fishing, forestry, construction, oil and gas, mining, and quarrying. Startups and MSME sector rely on LTL services for density-based pricing. Economic conditions and freight pricing trends influence the logistics sector's road freight services, affecting full truckload carriers, specialized carriers, and e-commerce businesses. Freight transport volume, retail shipping, industrial shipping, ground shipping, air shipping, and rail shipping are all affected by these challenges. Fuel costs remain a significant concern for freight carriers, impacting their bottom line.

Insights into how AI is reshaping industries and driving growth- Download a Sample Report

Segment Overview

This less-than-truckload (ltl) market report extensively covers market segmentation by

- 1.1 Long-haul carriers

- 1.2 Superregional carriers

- 1.3 Regional carriers

- 2.1 Light LTL volume and Heavy LTL volume

- 3.1 APAC

- 3.2 North America

- 3.3 Europe

- 3.4 Middle East and Africa

- 3.5 South America

1.1 Long-haul carriers- The global less-than-truckload (LTL) market's largest revenue contributor is the long-haul carrier segment. Long-haul LTL carriers, also known as national LTL carriers, transport shipments within 3 to 5 business days, covering an average distance of approximately 1,200 miles per haul. These carriers operate through a hub-and-spoke network and often have labor unions. The long-haul LTL carriers segment is projected to grow steadily due to economic conditions in the country. Long-haul LTL carriers offer value-added services, such as packing, unpacking, and door-to-door freight collection. Despite competition from other transportation modes, long-haul LTL carriers remain popular due to their efficiency and timely delivery. Businesses benefit from outsourcing their freight and transportation needs, as managing in-house transportation requires significant investment and expertise. The long-haul LTL carriers segment provides additional services, including project logistics, network planning, cargo insurance, value-chain optimization, and customs brokerage. The increase in industrial activities worldwide is expected to fuel the growth of the long-haul LTL carriers segment in the LTL market.

Download complimentary Sample Report to gain insights into AI's impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 - 2022)

Research Analysis

The Less-than-truckload (LTL) market plays a crucial role in transporting goods for various industries such as Agriculture, Fishing, Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, and Retail. Freight volumes in the LTL market are driven by the demand for transporting smaller consignments, making it an essential mode of transport for MSMEs. E-commerce and the logistics sector have significantly contributed to the growth of the LTL market in recent years. Freight pricing trends in the LTL market are influenced by factors like fuel prices, trailer capacity utilization, and cargo density. Scalability and affordability are key benefits of LTL services, making them a popular choice for shippers with smaller freight volumes. Road freight services are the primary mode of transport in the LTL market, offering flexibility and efficient delivery solutions. The LTL market caters to various industries, including Crude oil, where it is used for transporting drilling equipment and other supplies. Freight carriers offer customized solutions to meet the unique needs of different industries, ensuring timely and efficient delivery of cargo. The market is expected to continue growing due to increasing demand for affordable and flexible freight transportation solutions.

Market Research Overview

The Less-than-truckload (LTL) market caters to the shipping needs of various industries such as Agriculture, Fishing, Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, and others. Freight transport volume in the LTL market is driven by the demand for retail products, e-commerce, and MSME sector growth. Freight pricing trends are influenced by factors like fuel prices, operational efficiency, and economic conditions. LTL services offer scalability and affordability for small to medium shipments, making them popular among businesses. Road freight services dominate the LTL market due to their flexibility and wide reach. Logistics sector players provide LTL services for various industries, including retail and industrial shipping. Fuel prices, particularly for diesel and petrol, significantly impact LTL freight costs. Truckers and oil marketing companies play crucial roles in the LTL market, as they manage the supply of crude oil and the distribution of fuel to LTL carriers. Freight carriers offer LTL services for various industries, with full truckload carriers and specialized carriers catering to specific needs. Shippers look for trailer capacity and cargo density-based pricing to optimize their logistics costs. The LTL market is seeing innovation with the entry of startups offering volume LTL services and new pricing models like density-based pricing. Overall, the LTL market is essential for businesses seeking efficient and cost-effective freight transportation solutions.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Type

- Long-haul Carriers

- Superregional Carriers

- Regional Carriers

- Capacity

- Light LTL Volume And Heavy LTL Volume

- Geography

- APAC

- North America

- Europe

- Middle East And Africa

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/less-than-truckload-ltl-market-to-grow-by-usd-120-31-billion-2024-2028-driven-by-e-commerce-advances-report-on-ais-impact-on-redefining-market-landscape---technavio-302332010.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/less-than-truckload-ltl-market-to-grow-by-usd-120-31-billion-2024-2028-driven-by-e-commerce-advances-report-on-ais-impact-on-redefining-market-landscape---technavio-302332010.html

SOURCE Technavio