Electric Bus Market to grow by USD 21.0 Billion from 2024-2028, driven by reduced battery prices, with AI transforming market trends - Technavio

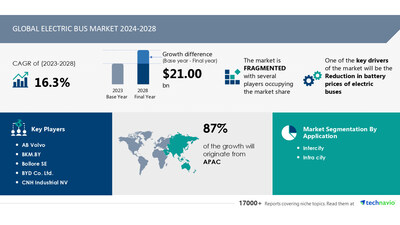

NEW YORK, Dec. 4, 2024 /PRNewswire/ -- Report with the AI impact on market trends - The global electric bus market size is estimated to grow by USD 21.0 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 16.3% during the forecast period. Reduction in battery prices of electric buses is driving market growth, with a trend towards increasing popularity of wireless charging systems. However, declining number of public transport users poses a challenge. Key market players include AB Volvo, BKM.BY, Bollore SE, BYD Co. Ltd., CNH Industrial NV, Complete Coach Works, Eletra, GreenPower Motor Co. Inc., Hyundai Motor Co., Jiangsu Alfa Bus Co. Ltd., Mercedes Benz Group AG, NFI Group Inc., Proterra Inc., Tata Motors Ltd., and Tecnobus Industries srl.

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View Free Sample PDF

Electric Bus Market Scope | |

Report Coverage | Details |

Base year | 2023 |

Historic period | 2018 - 2022 |

Forecast period | 2024-2028 |

Growth momentum & CAGR | Accelerate at a CAGR of 16.3% |

Market growth 2024-2028 | USD 21.00 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 15.55 |

Regional analysis | APAC, Europe, North America, Middle East and Africa, and South America |

Performing market contribution | APAC at 87% |

Key countries | US, China, India, UK, and Germany |

Key companies profiled | AB Volvo, BKM.BY, Bollore SE, BYD Co. Ltd., CNH Industrial NV, Complete Coach Works, Eletra, GreenPower Motor Co. Inc., Hyundai Motor Co., Jiangsu Alfa Bus Co. Ltd., Mercedes Benz Group AG, NFI Group Inc., Proterra Inc., Tata Motors Ltd., and Tecnobus Industries srl |

Market Driver

Electric buses are becoming a popular trend in the transport sector due to their non-polluting and air-combatant nature. Automobile manufacturers are focusing on producing fuel-efficient buses to address environmental concerns and meet zero emissions targets. Hydrogen fuel cell-powered buses and battery electric vehicles (BEVs) are leading the charge, with lithium iron phosphate batteries being a preferred choice due to their long life and safety. However, challenges such as low battery efficiency, battery performance, charging capacity, and charge duration remain. Transit agencies and OEMs are investing in charging infrastructure, including ebus charging stations, to support the EV transition. Urbanization and the need to reduce vehicle emissions, including carbon emissions and ozone-depleting substances, are driving the demand for electric buses. The transport sector is moving towards zero-emission vehicles, with hybrid buses (HEVs), plug-in hybrid vehicles (PHEVs), fuel cell electric vehicles (FCEVs), and battery electric buses (BEVs) becoming increasingly common. The shift from ICE-based buses to electric buses is also influenced by the rising cost of fossil fuels and the desire to reduce fuel expense. The electric bus ecosystem is expanding, with charging devices and hydrogen power becoming more accessible. Public health and the need to combat air pollution are also key factors in the adoption of electric buses.

The electric bus market is seeing advancements in charging technology with the introduction of inductive wireless charging systems. The US Department of Energy's Oak Ridge National Laboratory (ORNL) developed a 20-kW inductive wireless charging system, which significantly enhances the convenience for electric bus operators. During testing, an electric Toyota RAV4 equipped with an additional 10-kWh battery achieved 90% efficiency, three times better than plug-in systems. ORNL's innovation has paved the way for higher capacity wireless chargers, with a 50-kW power capacity now available, matching the capabilities of quick plug-in chargers in the market.

Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution!

Market Challenges

- Electric buses are gaining popularity as non-polluting and air-combatants in the transport sector. However, the transition from conventional bus fleets to electric buses comes with challenges. Environmental concerns and zero emissions targets push automobile manufacturers to produce fuel-efficient buses. Hydrogen fuel cell-powered buses and battery electric vehicles (BEVs) are two main types. BEVs face challenges like low battery efficiency, battery performance, charging capacity, and charge duration. Lithium iron phosphate batteries are commonly used in BEVs due to their safety and long life. Charging infrastructure is a crucial factor in the success of the electric bus ecosystem. Transit agencies and OEMs invest in charging devices like ebus charging stations. The cost of fossil fuel prices and fuel expense also influence the shift towards electric buses. Urbanization and public health concerns add to the urgency for zero-emission vehicles. Hybrid buses, plug-in vehicles, fuel cell vehicles, and hydrogen power are other alternatives. Vehicle emissions, including carbon emissions and ozone-depleting substances, contribute to air pollution and greenhouse gas emissions. Battery safety, battery types like lithium-ion batteries, and charging devices are essential considerations in the electric bus market. The EV transition requires collaboration between OEMs, transit agencies, and governments to build a charging infrastructure and address the challenges of battery electric vehicles.

- The electric bus market faces challenges due to decreasing demand for public transportation. Transit agencies are hesitant to invest in expensive electric buses as personal vehicles gain popularity. This trend is hindering market growth. Additionally, the rising production of affordable cars from major brands is further limiting the demand for electric buses. The shift towards budget and mini cars is reducing the need for public transportation services. These factors pose significant challenges to the electric bus market's expansion.

Discover how AI is revolutionizing market trends- Get your access now!

Segment Overview

This electric bus market report extensively covers market segmentation by

- 1.1 Intercity

- 1.2 Intra city

- 2.1 Pure electric bus

- 2.2 Plug-in hybrid bus

- 3.1 APAC

- 3.2 Europe

- 3.3 North America

- 3.4 Middle East and Africa

- 3.5 South America

1.1 Intercity- The Indian government aims to replace traditional internal combustion engine vehicles with electric vehicles by 2030, focusing on building infrastructure for electric vehicles, particularly electric buses, in tier-1 and tier-2 cities. This initiative presents a significant business opportunity for electric bus charging system manufacturers. In APAC, China is the leading market for electric buses, with the government actively promoting their use to reduce diesel emissions from buses. Most Chinese electric buses employ battery-swapping methods for quick recharging. However, the charging technology is slow and requires substantial time, indicating potential for improvement. These developments will boost the intercity segment in the global electric bus market.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics

Research Analysis

The electric bus market is gaining significant traction as the transport sector shifts towards non-polluting and fuel-efficient solutions. Conventional bus fleets are being replaced with zero-emission vehicles to combat air pollution and contribute to environmental concerns. Automobile manufacturers are investing heavily in hydrogen fuel cell-powered and battery-electric buses (BEV), offering faster charging infrastructure and longer ranges. Artificial Intelligence (AI) is being integrated into electric buses for optimized energy management and improved safety. Zero emissions targets are driving the demand for electric buses, as they produce no vehicle emissions and do not use ozone-depleting substances. Electric vehicle batteries, such as lithium-ion, are a critical component, with advancements in battery safety and battery management systems improving their performance and longevity. Hybrid electric buses (HEV) and all-electric buses (BEV) are replacing diesel fueled buses to reduce greenhouse gas emissions and promote sustainable transportation.

Market Research Overview

Electric buses are becoming an increasingly popular solution in the transport sector as concerns over vehicle emissions, air pollution, and greenhouse gas (GHG) emissions continue to grow. These non-polluting, fuel-efficient buses offer a significant reduction in ozone-depleting substances and carbon emissions compared to conventional bus fleets. Automobile manufacturers are responding to these environmental concerns by producing various types of electric buses, including battery electric vehicles (BEV), plug-in vehicles (PHEV), and fuel cell vehicles (FCEV). Hydrogen fuel cell-powered buses, in particular, offer long range and quick refueling times, making them ideal for intercity transportation. However, challenges such as low battery efficiency, battery performance, charging capacity, and charge duration remain. Artificial Intelligence and advanced charging devices are being integrated into the electric bus ecosystem to address these challenges. Urbanization and the transition to zero-emission vehicles are driving demand for electric buses in both public and private sectors. Transit agencies and OEMs are investing in charging infrastructure to support the growing number of electric buses. Hybrid buses, including HEV and plug-in hybrids, are also gaining popularity as a bridge technology in the EV transition. The cost of fossil fuels and the expense of fueling diesel-fueled buses are further incentivizing the adoption of electric buses. Despite these advancements, safety concerns surrounding electric vehicle batteries, particularly lithium-ion batteries, must be addressed to ensure the widespread adoption of electric buses.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Application

- Intercity

- Intra City

- Type

- Pure Electric Bus

- Plug-in Hybrid Bus

- Geography

- APAC

- Europe

- North America

- Middle East And Africa

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/electric-bus-market-to-grow-by-usd-21-0-billion-from-2024-2028--driven-by-reduced-battery-prices-with-ai-transforming-market-trends---technavio-302320925.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/electric-bus-market-to-grow-by-usd-21-0-billion-from-2024-2028--driven-by-reduced-battery-prices-with-ai-transforming-market-trends---technavio-302320925.html

SOURCE Technavio