VantageScore CreditGauge™ October 2024: Higher Income and White-Collar Consumers Increasingly Experiencing Rising Credit Delinquencies

- Inflation increasingly impacts 'white-collar' workers and their credit payments

- New credit accounts decreased across most loan products for the second straight month, led by declines in new Credit Cards and Personal Loans

- Credit Card account balances remained flat as increased borrowing paused in October amid economic uncertainty

SAN FRANCISCO, Nov. 26, 2024 /PRNewswire/ -- VantageScore, a leading national credit-scoring company, today released its October 2024 CreditGauge, a monthly analysis highlighting the overall health of U.S. consumer credit. The average VantageScore 4.0 credit score decreased slightly but held at 702 for the eighth consecutive month. The lowest VantageScore 4.0 credit score is 300, while the highest score is 850. Overall, the percentage of consumers with newly opened credit accounts dropped for the second month in a row, and credit card balances remained flat compared to the month before.

"Low-income consumers are no longer the only group facing challenges. More affluent and white-collar workers are also facing pressure from inflation and a less healthy job market," said Susan Fahy, Executive Vice President and Chief Digital Officer at VantageScore. "This economic reality will weigh on the holiday shopping season."

Key insights for October 2024 CreditGauge include:

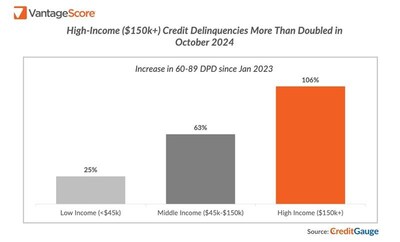

WHITE-COLLAR CONSUMERS INCREASINGLY EXPERIENCED RISING CREDIT DELINQUENCIES: VantageScore high-income ($150k+) credit delinquencies in the 60-89 Days Past Due category more than doubled from January 2023 to October 2024. This increase significantly outpaced the growth among middle-income earners by 63% and low-income earners by 25%, underscoring that even high-income groups are feeling the effects of financial strain, compounded by the ongoing slump in white-collar employment.

ORIGINATIONS DECLINED ACROSS ALL PRODUCTS: Newly opened credit accounts fell across all products month-over-month. New Credit Card, Personal Loan and Auto Loan accounts all declined sharply compared to September 2024. Credit Cards fell the most among all credit products, dropping 0.25% compared to September 2024. The decline reflected seasonal patterns as consumers paused opening new accounts due to market uncertainty ahead of the U.S. National elections.

CREDIT CARD ACCOUNT BALANCES REMAINED FLAT; MORTGAGE BALANCES HIT NEW HIGH: In October 2024, overall balances hit a new CreditGauge record for a fourth consecutive month, driven by Mortgage loans. Overall credit balances rose by $384 (+0.4%) month-over-month and $2,218 (+2.1%) year-over-year to $105,600. Credit Card balances remained flat at $6,335 in October 2024 compared to September 2024, reflecting cautious spending by consumers ahead of the election and the holidays. The average Mortgage balance rose by $6813 (+2.6%) year-over-year from October 2023 to October 2024 driven by higher interest rates and higher loan amounts due to elevated home prices. The overall amount of available credit that borrowers used remained steady at 51.7%.

To view the full CreditGauge report, visit the VantageScore website.

About VantageScore CreditGauge™

CreditGauge is provided both as a monthly analysis to industry stakeholders as well as through a series of interactive tools at VantageScore.com, which also includes Inclusion360®, RiskRatio™ and MarketGain™. Stakeholders can use the tools to execute additional queries on credit metrics and compare current levels to a pre-pandemic timeframe, starting with January 2020. CreditGauge solely represents the views and analysis of VantageScore and does not necessarily reflect or represent the views of the Nationwide Consumer Reporting Agencies (NCRAs) – Equifax, Experian, and TransUnion.

About VantageScore®

VantageScore is the fastest-growing credit scoring company in the U.S., and is known for the industry's most innovative, predictive, and inclusive credit score models. In 2023, usage of VantageScore increased by 42% to more than 27 billion credit scores. More than 3,400 institutions, including 8 of the top 10 banks, use VantageScore credit scores to provide consumer credit products including credit cards, auto loans, personal loans and mortgages. The VantageScore 4.0 credit scoring model scores 33 million more people than traditional models. With the FHFA mandating the use of VantageScore 4.0 for Fannie Mae and Freddie Mac guaranteed mortgages, the company is also ushering in a new era for mortgage lending and helping to close the homeownership gap.

VantageScore is an independently managed joint venture company of the three Nationwide Consumer Reporting Agencies (NCRAs) – Equifax, Experian, and TransUnion.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/vantagescore-creditgauge-october-2024-higher-income-and-white-collar-consumers-increasingly-experiencing-rising-credit-delinquencies-302316033.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/vantagescore-creditgauge-october-2024-higher-income-and-white-collar-consumers-increasingly-experiencing-rising-credit-delinquencies-302316033.html

SOURCE VantageScore