OceanaGold Continues to Demonstrate Exploration Upside at Wharekirauponga Ahead of Upcoming NI 43-101 Pre-feasibility Study

Werte in diesem Artikel

VANCOUVER, BC, Nov. 14, 2024 /PRNewswire/ - OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) ("OceanaGold" or the "Company") is pleased to announce results from the ongoing exploration and resource conversion program at Wharekirauponga, located ~10 kilometres from the Waihi operation, New Zealand. The Company is planning to release a NI 43-101 pre-feasibility study for the Waihi North Project and existing Waihi operation on December 11, 2024, details of which are provided later in this release.

Highlight Drill Intercepts (estimated true width):

- 34.7 g/t Au over 4.2 m from 563.5 m, EG vein (WKP124B)

- 16.8 g/t Au over 5.7 m from 644.3 m, EG FW vein (WKP124C)

- 11.4 g/t Au over 7.7 m from 453.5 m, EG vein (WKP134A)

- 13.0 g/t Au over 6.6 m from 233.4 m, EG vein (WKPP15D)

- 54.9 g/t Au over 1.4 m from 531.6 m, EG vein (WKP124D)

- 29.3 g/t Au over 2.4 m from 589.9 m, EG FW vein (WKP124D)

- 11.1 g/t Au over 2.8 m from 549.8 m and 21.4 g/t over 3.8 m from 603.9 m, EG FW veins (WKP124D)

Gerard Bond, President & CEO of OceanaGold, said "Today's results demonstrate the phenomenal exploration upside potential at Wharekirauponga with new intercepts along the EG vein zone continuing to return high-grade over excellent widths. We are preparing the results of the NI 43-101 pre-feasibility study which is planned to be released in December, and we expect will highlight the value, longevity and potential of this exceptional deposit."

Results Overview

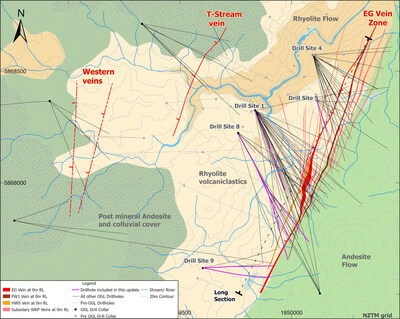

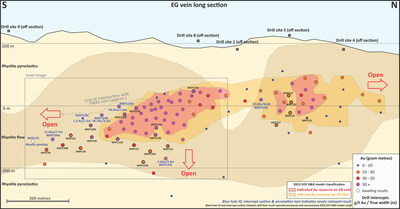

Since the August 8, 2024 Wharekirauponga news release, extensional drilling has intersected significant mineralization in all six holes on the East Graben (EG) vein and associated hanging-wall and foot-wall veins (EG vein zone) in both the high-grade southern and northern zone (Table 1, Figures 1 and 2). Results demonstrate the continued potential of extensions to the EG vein and numerous hanging wall (HW) and footwall (FW) veins and definition of high-grade shoots. The NI 43-101 pre-feasibility study, planned for release in December, will be based on the resource model as at the end of May 2024. The exploration results released today, and in August, represent further upside potential to the outcomes of the upcoming study.

Extensional Drilling

Drilling highlighted in this release was completed from four sites including drill site 9 which was commissioned in March 2024. Drill site 9 has enabled drill testing of ~800m of southern strike extension of the EG vein zone. Four holes targeted resource extensions to the high-grade southern EG zone with 1 hole drilled from site 9, 2 holes drilled from site 8 and 1 hole drilled from site 1, all of which intersected significant high-grade mineralization (Figure 2).

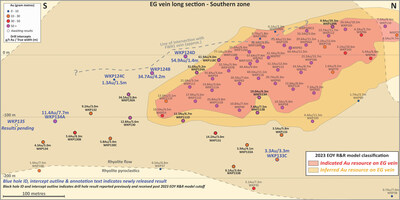

Holes WKP124B, WKP124D and WKP134A demonstrate excellent grade and width in the unconstrained up-dip and strike dimensions of the southern limb while hole WKP133C extends grade continuity at depth. These high-grade intercepts demonstrate geological and grade continuity of the EG vein with geological continuity further supported by intersection of 6.3m (true width) of vein in WKP135, the southernmost hole from drill site 9 (results pending, Figure 3).

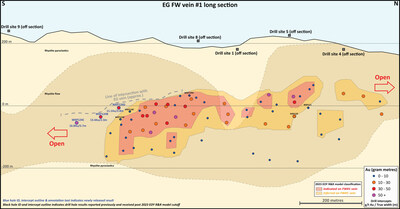

Hole WKP124C is the southernmost hole drilled across the footwall vein providing an 85m extension south from previous results (Figure 4). Although this hole intersected modest grade and width in the EG vein, high-grade and relatively wide mineralization of 16.8 g/t Au over 5.7 metres (true width) was intersected in the footwall. Hole WKP124D also intersected a wide zone of veining in the footwall with high-grade intersections across multiple footwall vein structures, including 11.1 g/t Au over 2.8 metres (true width, Figure 4) and 29.3 g/t Au over 2.4 metres and 21.4 g/t over 3.8 metres within newly identified veins, confirming further significant upside in the footwall to the EG vein as we step out to the south. Opportunity remains for up-plunge, down-plunge, and along-strike extensions on this and other attendant hanging and footwall veins.

Within the northern shoot of the EG vein, hole WKPP15D intersected 13 g/t Au over 6.6 metres and demonstrates ongoing potential for growth via definition of high-grade shoots within the existing resource footprint. Drilled from site 5, this hole supports the model with significant grade and width, remaining open for further testing of a ~200 metre down-plunge extension in the central EG vein at elevations favourable for high-grade mineralization (Figure 2).

The EG vein zone remains the primary, near-term drill target for the 2024 growth and conversion program and will continue through 2025.

2024 Exploration Program

Exploration drilling for the remainder of the 2024 program will target resource growth from drill sites 8 and 9, testing beyond the current southern extent of drilling, and up and down-dip of both current and future extension holes in the south. A further hole from drill site 5 will target the down-dip extension of WKP15D in the EG northern shoot.

The NI 43-101 pre-feasibility study that is planned to be released in December 2024 will be based on the resource model as at the end of May 2024. Subsequent drill results will be captured in an end-of-year resource model update to be released with the 2024 end of year resource statement.

For maps and sections see Figures 1-4 and Table 1 for full results.

Table 1: Wharekirauponga drill intersections subsequent to the August 8, 2024 exploration update

Drillhole ID | From (m) | To (m) | True width (m) | Au (g/t) | Ag (g/t) | Vein | Purpose |

WKP124C | 612.8 | 614.5 | 1.5 | 1.3 | 1.6 | EG | Extension |

WKP124C | 644.3 | 652.4 | 5.7 | 16.8 | 11.7 | EG FW (430) | Extension |

WKP133C | 487.9 | 491.9 | 3.3 | 3.3 | 6.8 | EG | Extension |

WKP134A | 453.5 | 462.4 | 7.7 | 11.4 | 11.7 | EG | Extension |

WKP124B | 563.5 | 569.5 | 4.2 | 34.7 | 24.8 | EG | Extension |

WKP124B | 575 | 578.2 | 1.4 | 22.1 | 14.5 | EG FW (430) | Extension |

WKP124D | 531.6 | 533.6 | 1.4 | 54.9 | 39.8 | EG | Extension |

WKP124D | 549.8 | 553.5 | 2.8 | 11.1 | 12.5 | EG FW (430) | Extension |

WKP124D | 589.9 | 593.3 | 2.4 | 29.3 | 14.7 | EG FW (unmodelled) | Extension |

WKP124D | 603.9 | 610.6 | 3.8 | 21.4 | 19.7 | EG FW (unmodelled | Extension |

WKPP15D | 233.4 | 241.4 | 6.6 | 13.0 | 30.6 | EG | Conversion |

For further information relating to drill hole data for WKP, please refer to the Company's website at https://investors.oceanagold.com/additional-drillhole-data.

About Wharekirauponga and the Waihi North Project

The Wharekirauponga low-sulphidation epithermal Au-Ag vein system is located approximately 10 kilometres north of the Company's Waihi operation. The Wharekirauponga Indicated Resource stands at 2.0 million tonnes grading 15.9 g/t Au for 1.01 million ounces of gold with a further 1.2 million tonnes grading 9.0 g/t Au for 0.35 million ounces of gold in the Inferred category as of December 31, 2023.

Wharekirauponga is part of the Waihi North Project, which has the potential to create significant socio-economic contributions for the communities in the Waihi region and for New Zealand. This includes significant in-country investments and a substantial increase to direct and indirect employment opportunities, with the project having the potential to extend operation of the Waihi mine beyond the next decade. OceanaGold operates to the highest environmental and social standards which has enabled it to run a successful and responsible mining business in New Zealand for over three decades. The Company has lodged a resource consent application for its proposed Waihi North Project with Hauraki District Council and Waikato Regional Council and has recently been listed as a proposed project under the Fast-track Approvals Bill in New Zealand.

NI 43-101 Pre-Feasibility Study Release Date

The Company plans to release the results of the NI 43-101 pre-feasibility study for the Waihi North Project after market close on Wednesday December 11, 2024. The results will be made available on the Company's website at www.oceanagold.com. Senior management will host a webcast to discuss the results on Thursday December 12, 2024 at 10:00 am Eastern Time.

To register, please copy and paste the link into your browser: https://app.webinar.net/DdjR72Pnakx

If you are unable to attend the webcast, a recording will be made available on the Company's website.

About OceanaGold

OceanaGold is a growing intermediate gold and copper producer committed to safely and responsibly maximizing the generation of Free Cash Flow from our operations and delivering strong returns for our shareholders. We have a portfolio of four operating mines: the Haile Gold Mine in the United States of America; Didipio Mine in the Philippines; and the Macraes and Waihi operations in New Zealand. For further information please contact:

Quality Assurance and Quality Control (QA/QC) at Wharekirauponga, Waihi Gold Mine

All exploration samples are assayed for gold by 30g fire assay with AAS finish. Since mid-2022 drill core sample intervals where visible electrum is logged are followed up by a subsequent screen fire assay after the routine 30g fire assay. Holes WKP40-45 had core samples shipped for sample preparation to SGS in Westport (New Zealand). Prepared pulps were then shipped to independent Australian Laboratory Services Pty Ltd (ALS) in Brisbane, accredited to ISO/NATA 17025 for gold analysis by fire assay and 4-acid digest, and 42 element ICP geochemical analysis. Holes drilled after WKP45 (i.e., WKP46 to WKP134) were prepared and analyzed at SGS Waihi NZ Ltd (Au by 30g fire assay and Ag by aqua regia digest and 0.3gm AAS finish). Selected pulps are periodically sent to ALS in Brisbane for a 4-acid digestion and 42 or 48 element ICP geochemical analysis.

Quality of exploration assay results has been monitored in the following areas:

- Sample preparation at the SGS Waihi and Westport labs through sieving of jaw crush and pulp products.

- Monitoring of assay precision through routine generation of duplicate samples from a second split of the jaw crush and calculation of the fundamental error.

- Monitoring of accuracy of the primary SGS assay and ALS results through insertion Certified Reference Materials (CRM's) and blanks into sample batches.

Blank, duplicate and CRM results are reviewed prior to uploading results in the AcQuire database and again on a weekly basis. The protocol at Waihi requires CRMs to be reported to within 2 standard deviations of the certified value. The criterion for preparation duplicates is that they have a relative difference (R-R1/mean RR1) of no greater than 10%. Blanks should not exceed more than 4 times the lower detection value of the assay method. Failure in any of these thresholds triggers an investigation and if appropriate re-assay. Drill core is stored within secure facilities on site to which access is controlled. Site employees transport samples to the analytical laboratory which is also a secured facility. The SGS Waihi NZ Ltd laboratory is an independent commercial geochemistry and energy assay laboratory with ISO 17025: 2017 accreditation, audited by an external consultant in 2020, and is inspected on an annual basis by OceanaGold geologists. No sampling risks have been recorded during these visits.

Qualified Person Statement

The exploration results in this press release were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101").

Information relating to Waihi exploration results in this document has been verified by, is based on and fairly represents information compiled by or prepared under the supervision of Leroy Crawford-Flett, a Chartered Professional Member of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Mr Crawford-Flett has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as Qualified Persons for the purposes of the NI 43-101. Mr Crawford-Flett consents to the inclusion in this public report of the matters based on their information in the form and context in which it appears.

Technical Reports

For further information, please refer to the following NI 43-101 compliant technical report available on the SEDAR+ website at www.sedarplus.com under the Company's name and the Company's news release titled "OceanaGold Reports Mineral Reserves and Resources for the Year Ended 2023" dated February 21, 2024:

(a) | "Waihi District Study - Preliminary Economic Assessment NI 43-101 Technical Report" dated August 30, 2020, prepared by T. Maton, Study Manager and P. Church, Principal Resource Development Geologist, both of Oceana Gold (New Zealand) Limited, and D. Carr, Chief Metallurgist, of OceanaGold Management Pty Limited. |

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed "forward-looking" within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company's expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company's most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR+ at www.sedarplus.com under the Company's name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/oceanagold-continues-to-demonstrate-exploration-upside-at-wharekirauponga-ahead-of-upcoming-ni-43-101-pre-feasibility-study-302305345.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/oceanagold-continues-to-demonstrate-exploration-upside-at-wharekirauponga-ahead-of-upcoming-ni-43-101-pre-feasibility-study-302305345.html

SOURCE OceanaGold Corporation

Ausgewählte Hebelprodukte auf OceanaGold

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf OceanaGold

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Nachrichten zu OceanaGold CorpShs

Analysen zu OceanaGold CorpShs

| Datum | Rating | Analyst | |

|---|---|---|---|

| 06.07.2012 | OceanaGold buy | Citigroup Corp. | |

| 06.01.2012 | OceanaGold outperform | Macquarie Research | |

| 06.02.2009 | OceanaGold spekulative Goldwette | Hanseatischer Börsendienst |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 06.07.2012 | OceanaGold buy | Citigroup Corp. | |

| 06.01.2012 | OceanaGold outperform | Macquarie Research | |

| 06.02.2009 | OceanaGold spekulative Goldwette | Hanseatischer Börsendienst |

| Datum | Rating | Analyst | |

|---|---|---|---|

Keine Analysen im Zeitraum eines Jahres in dieser Kategorie verfügbar. Eventuell finden Sie Nachrichten die älter als ein Jahr sind im Archiv | |||

| Datum | Rating | Analyst | |

|---|---|---|---|

Keine Analysen im Zeitraum eines Jahres in dieser Kategorie verfügbar. Eventuell finden Sie Nachrichten die älter als ein Jahr sind im Archiv | |||

Um die Übersicht zu verbessern, haben Sie die Möglichkeit, die Analysen für OceanaGold CorpShs nach folgenden Kriterien zu filtern.

Alle: Alle Empfehlungen