Silvercorp Provides Plan to Develop the Condor Gold Project as a High-Grade Underground Mine

Werte in diesem Artikel

Trading Symbols: SVM (TSX/NYSE American)

VANCOUVER, BC, Dec. 4, 2024 /PRNewswire/ - Silvercorp Metals Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) is pleased to report its plans to develop the Condor gold project (the "Project"), located in southern Ecuador. A preliminary economic assessment (PEA) was completed on the Project1 by a previous operator, which outlined a high tonnage, low-grade, open pit gold project.

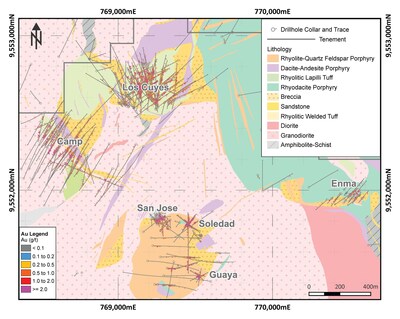

The Project comprises a cluster of gold deposits in the Condor North area (Figure 1), with Camp and Los Cuyes contributing the majority of the known mineral resources. Each deposit is unique and different from the others on a deposit scale. Previous drilling reported numerous long core intersections of gold mineralization, usually consisting of higher-grade intervals and surrounding lower-grade halos.

After reviewing the technical Project data, including re-logging of the historical core, the Company believes that high-grade gold mineralization mostly occurs in subvertical vein/rhyolitic dyke structures containing pyrite and sphalerite. Minor amounts of galena and chalcopyrite are also present and may form low grade halos, which can be quite extensive along certain volcanic layers.

Select drilling intercepts (Table 1), show higher-grade drill intervals with true widths over 3.5 metres ("m"). This highlights the potential for selective underground mining at Condor. Noteworthy intercepts include:

- Camp: CC19-01, 9.03 grams per tonne ("g/t") over 8.05 m true width from 260 m

- Enma: DEN-31, 44.16 g/t Au over 4.5 m true width from 90 m

- Los Cuyes: DCU-17B, 8.98 g/t Au over 16.7 m true width from 202 m

- San Jose: DD-004, 9.00 g/t Au over 21.1 m true width from surface

________________________________ |

1 Condor Project NI 43-101 Report on Preliminary Economic Assessment Zamora-Chinchipe, Ecuador, July 28, 2021, filed under Luminex Resources on Sedar+ |

Development Plan for a Possible Underground Operation

In order to advance the Condor gold project as an underground operation, the Company will focus on high-grade gold structures/rhyolitic dykes. Work to be conducted may include:

1. | Studies and Permitting | ||

a. | Re-estimate mineral resources as an underground focused operation. | ||

b. | Publish a Preliminary Economic Assessment as an underground mine operation. | ||

c. | Execute community agreements and complete government permitting process in order to develop exploration tunnels. | ||

2. | Underground Tunneling | ||

a. | Develop two cross-cut exploration access tunnels, at two different elevations, to confirm the high-grade gold intervals. | ||

b. | Conduct underground drilling to inform a future feasibility study and to improve the understanding of the geology. | ||

3. | Construction Readiness | ||

a. | Complete a feasibility study based on the data gathered from the underground tunneling program. | ||

b. | Complete permitting for a process plant, underground mine and tailings storage facility. | ||

c. | Construction decision. | ||

4. | Drilling: | ||

Limited drilling will target the high-grade mineralized structures by optimizing the grid pattern and could include: | |||

a. | Infill drilling: Targeted between previous drill sections to confirm the continuity of high-grade mineralized structures. | ||

b. | Step-out drilling: Targeted along strike and dip of known high-grade zones to increase the mineral resource. | ||

c. | New targets: | ||

a) | Broad zones of sub-horizontal disseminated gold mineralization which occur within the rhyolitic tuffs at Los Cuyes. | ||

b) | Contact zone of crypto rhyolite domes with batholith granodiorite for wide mineralization at Camp. | ||

c) | Region between the Camp and Los Cuyes deposits. | ||

d) | Gap area between Camp and Soledad, testing for potential connection of NW trending mineralized structures across the two deposits and for potential strike extension of NW trending mineralized structures. | ||

e) | Gap between the Los Cuyes and Enma deposits for potential strike extension of NW trending mineralized structures. | ||

f) | Test expansion potential of near-surface, high-grade breccia deposits such as San Jose/Soledad. | ||

Deposit Descriptions

The Condor deposits are hosted in a Cretaceous volcanic complex of diatremes and rhyolite/dacite intrusives crosscutting the Zamora batholith granodiorite of Jurassic age. The Project consists of the following five known deposits:

- Los Cuyes: Gold is hosted in a volcanic diatreme which crosscuts a granodiorite batholith. The diatreme, with a dimension of 450m in NE-SW x 300m in NW-SE x 350m depth comprises phreatomagmatic breccias, tuff and sediments, all of which are cross-cut by NW and NE striking dykes of rhyolite and dacite.

Gold mineralization mostly occurs in subvertical vein structures containing pyrite and sphalerite with minor amounts of galena and chalcopyrite. The vein-like mineralisation primarily occurs along the contact zones of intrusive dykes with the surrounding volcanics and Granodiorite batholith. In addition, gold is also associated with sulfide dissemination occurring in rhyolitic tuff units, resulting in wide sub-horizontal zones of gold mineralization. - Camp: Gold mineralization occurs within veins of pyrite/sphalerite and is controlled by NW striking rhyolite dykes at shallow levels, as well as crypto intrusive domes of rhyolite at depth. Gold mineralization remains open beyond a depth of 700 metres based on existing drill data.

- Soledad: Gold mineralization is associated with pyrite/sphalerite replacement of feldspar grains (patchy) or veins hosted in a rhyodacite porphyry. At San Jose, gold mineralization consists of sphalerite-rich veins hosted in phreatomagmatic breccia.

- Guaya: Gold mineralization is associated with pyrite-sphalerite veins hosted in a rhyo-dacite porphyry.

- Enma: Gold mineralization occurs within veins of pyrite/sphalerite hosted in the rhyolitic breccia along the contact between dacitic tuff and granodiorite batholith.

Table 1 Select High-Grade Drill Intervals from Previous Drilling | ||||||||

Area | Hole ID | From (m) | To (m) | Interval (m) | Estimated True Width (m) | Au (g/t) | Ag (g/t) | Zn (%) |

Camp | CC19-01 | 260.13 | 272.00 | 11.87 | 8.05 | 9.03 | 9 | 0.25 |

Camp | CC19-02_EXT | 308.00 | 323.44 | 15.44 | 10.70 | 5.11 | 12 | 0.69 |

Camp | CC19-03 | 155.00 | 167.00 | 12.00 | 7.30 | 7.27 | 19 | 0.43 |

Camp | 173.00 | 185.00 | 12.00 | 7.30 | 5.25 | 9 | 0.62 | |

Camp | CC19-11 | 114.00 | 126.00 | 12.00 | 8.90 | 5.55 | 11 | 0.52 |

Camp | CC19-12 | 646.00 | 665.30 | 19.30 | 9.50 | 6.09 | 36 | 1.25 |

Camp | CC19-14 | 209.00 | 227.00 | 18.00 | 7.10 | 5.85 | 35 | 2.26 |

Camp | CC19-21 | 348.00 | 358.00 | 10.00 | 6.00 | 8.39 | 99 | 3.17 |

Camp | CC20-28 | 421.00 | 432.00 | 11.00 | 7.05 | 7.56 | 184 | 4.39 |

Camp | CC20-29 | 628.00 | 638.00 | 10.00 | 6.71 | 6.34 | 38 | 2.25 |

Enma | DEN-31 | 90.00 | 106.00 | 16.00 | 4.50 | 44.16 | 561 | 0.29 |

Los Cuyes | CU23-17 | 255.40 | 268.00 | 12.60 | 8.10 | 5.58 | 79 | 0.31 |

Los Cuyes | CU23-20 | 269.00 | 281.00 | 12.00 | 8.10 | 5.55 | 52 | 0.56 |

337.00 | 343.00 | 6.00 | 4.08 | 7.81 | 18 | 0.12 | ||

Los Cuyes | CU23-22 | 314.00 | 319.00 | 5.00 | 3.50 | 15.77 | 107 | 2.6 |

Los Cuyes | CU23-25 | 221.00 | 247.00 | 26.00 | 15.80 | 5.87 | 25 | 0.72 |

Los Cuyes | DC001 | 238.00 | 245.00 | 7.00 | 4.87 | 8.78 | 28 | 1.05 |

Los Cuyes | DCU-17B | 202.00 | 242.00 | 40.00 | 16.70 | 8.98 | 55 | 2.78 |

Los Cuyes | 274.00 | 296.00 | 22.00 | 9.00 | 8.14 | 33 | 2.44 | |

Los Cuyes | DCU-18 | 296.00 | 312.00 | 16.00 | 4.30 | 5.10 | 51 | 2.42 |

Los Cuyes | DCU-27 | 94.00 | 112.00 | 18.00 | 4.50 | 5.56 | 9 | 0.05 |

Los Cuyes | DCU-41 | 262.00 | 274.80 | 12.80 | 7.60 | 5.30 | 43 | 0.73 |

San Jose | DD-004 | 0.00 | 45.00 | 45.00 | 21.10 | 9.00 | 7 | 0.76 |

San Jose | DD-005 | 1.00 | 13.41 | 12.41 | 9.00 | 10.70 | 7 | 0.72 |

San Jose | DD-005A | 2.00 | 20.00 | 18.00 | 15.10 | 10.00 | 10 | 0.52 |

San Jose | DD-005A | 29.00 | 40.00 | 11.00 | 7.80 | 5.40 | 5 | 0.21 |

San Jose | DD-006 | 0.91 | 24.00 | 23.09 | 9.60 | 5.66 | 5 | 0.84 |

San Jose | DD-053 | 91.00 | 101.00 | 10.00 | 5.40 | 5.91 | 33 | 0.32 |

San Jose | DSJ-03 | 42.50 | 52.50 | 10.00 | n/a | 5.70 | 4 | 0.27 |

San Jose | DSJ-07 | 25.00 | 40.00 | 15.00 | 5.50 | 6.80 | 2 | 0.38 |

San Jose | DSJ-09 | 20.00 | 45.47 | 25.47 | n/a | 5.00 | 13 | 0.47 |

San Jose | DSJ-10 | 5.00 | 22.50 | 17.50 | n/a | 5.50 | 5 | 0.16 |

San Jose | DSJ-17 | 5.55 | 38.05 | 32.50 | n/a | 5.20 | 9 | 0.58 |

San Jose | DSJ-19 | 0.00 | 10.00 | 10.00 | n/a | 9.20 | 8 | 0.58 |

Note: |

1). The compositing of drill intercepts is done using a cut-off grade of 2g/t gold, may include lower grade samples within. |

2). True width is estimated based on the current interpretation of mineralized structures. |

3). n/a - no adequate information to make estimate of true width |

Figure 1: Condor plan view showing deposits

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., technical consultant of Silvercorp (the "Qualified Person"), who is a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") for the purposes of NI 43-101.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company's strategy is to create shareholder value by 1) focusing on generating free cashflow from long-life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) a long-term commitment to responsible mining and ESG. For more information, please visit our website at www.silvercorpmetals.com.

For further information:

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@silvercorp.ca

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER - FORWARD-LOOKING STATEMENTS

This news release includes "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable securities laws relating to, among other things the discussions regarding the grade gold mineralization, the development plan for a possible underground operation, including with respect to future drilling, the timing of publication of technical reports for the Project as an underground mine operation, executing community agreements and the government permitting process in order to develop exploration tunnels and the timing thereof. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to the exploration, development, production, recoveries and other anticipated or possible future developments at Condor including, without limitation, risks relating to inaccurate geological and engineering assumptions; risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); escalation in artisanal and/or illegal mining activity, incursions, or incidents of local community unrest in response to increased Project activity, social opposition generated by interference from external actors, including illegal mining interests, environmental or social activists, and politicians, who may oppose activity at the Project, risks relating to adverse weather conditions; changes in general economic conditions or conditions in the financial markets; and general economic, business and political conditions. Forward-looking information may in some cases be identified by words such as "will", "anticipates", "expects", "intends" and similar expressions suggesting future events or future performance.

We caution that all forward-looking information is inherently subject to change and uncertainty and that actual results may differ materially from those expressed or implied by the forward-looking information. A number of risks, uncertainties and other factors, including social and political riskcould cause actual results and events to differ materially from those expressed or implied in the forward-looking information or could cause our current objectives, strategies and intentions to change. Accordingly, we warn investors to exercise caution when considering statements containing forward-looking information and that it would be unreasonable to rely on such statements as creating legal rights regarding our future results or plans. We cannot guarantee that any forward-looking information will materialize and you are cautioned not to place undue reliance on this forward-looking information. Any forward-looking information contained in this news release represent expectations as of the date of this news release and are subject to change after such date. However, we are under no obligation (and we expressly disclaim any such obligation) to update or alter any statements containing forward-looking information, the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking information in this news release is qualified by the cautionary statements herein.

A comprehensive discussion of other risks that impact Silvercorp can also be found in their public reports and filings which are available under its profile at www.sedarplus.ca.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-provides-plan-to-develop-the-condor-gold-project-as-a-high-grade-underground-mine-302322127.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-provides-plan-to-develop-the-condor-gold-project-as-a-high-grade-underground-mine-302322127.html

SOURCE Silvercorp Metals Inc

Ausgewählte Hebelprodukte auf Silvercorp Metals

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf Silvercorp Metals

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Nachrichten zu Silvercorp Metals Inc.

Analysen zu Silvercorp Metals Inc.

| Datum | Rating | Analyst | |

|---|---|---|---|

| 01.06.2018 | Silvercorp Metals Outperform | BMO Capital Markets | |

| 15.11.2012 | Silvercorp Metals neutral | UBS AG | |

| 10.09.2012 | Silvercorp Metals neutral | UBS AG | |

| 08.08.2012 | Silvercorp Metals outperform | Raymond James Financial, Inc. | |

| 07.08.2012 | Silvercorp Metals neutral | UBS AG |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 01.06.2018 | Silvercorp Metals Outperform | BMO Capital Markets | |

| 08.08.2012 | Silvercorp Metals outperform | Raymond James Financial, Inc. | |

| 06.06.2012 | Silvercorp Metals buy | UBS AG | |

| 01.06.2012 | Silvercorp Metals outperform | Raymond James Financial, Inc. | |

| 22.05.2012 | Silvercorp Metals buy | UBS AG |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 15.11.2012 | Silvercorp Metals neutral | UBS AG | |

| 10.09.2012 | Silvercorp Metals neutral | UBS AG | |

| 07.08.2012 | Silvercorp Metals neutral | UBS AG | |

| 06.08.2012 | Silvercorp Metals neutral | UBS AG | |

| 10.07.2012 | Silvercorp Metals neutral | UBS AG |

| Datum | Rating | Analyst | |

|---|---|---|---|

Keine Analysen im Zeitraum eines Jahres in dieser Kategorie verfügbar. Eventuell finden Sie Nachrichten die älter als ein Jahr sind im Archiv | |||

Um die Übersicht zu verbessern, haben Sie die Möglichkeit, die Analysen für Silvercorp Metals Inc. nach folgenden Kriterien zu filtern.

Alle: Alle Empfehlungen