U.S. GoldMining More Than Doubles Indicated Mineral Resource Estimate to 6.48 Million AuEq Oz with an Additional 4.16 Million AuEq Oz Inferred for the Whistler Project, Alaska

Werte in diesem Artikel

ANCHORAGE, Alaska, Oct. 7, 2024 /PRNewswire/ - U.S. GoldMining Inc. (NASDAQ: USGO) ("U.S. GoldMining" or the "Company") is pleased to announce an updated Mineral Resource Estimate ("MRE") for the Company's 100% owned Whistler Gold-Copper Project (the "Project") in Alaska, U.S.A. The updated MRE is set forth in a technical report summary titled " S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project, South Central Alaska " with an effective date of September 12, 2024, which was filed today under subpart 1300 of Regulation S-K ("SK-1300") and available under the Company's profile at www.sec.gov (the "S-K 1300 Report"). The estimate incorporates 2023 drilling results, revised geological interpretation within the Whistler Deposit, and refreshed cut-off grade assumptions for the overall Project.

Highlights:

- Indicated Mineral Resource: 294 million tonnes ("Mt") at 0.68 grams per tonne ("g/t") gold equivalent ("AuEq") for 6.48 million ounces ("Moz") AuEq

- Inferred Mineral Resource: 198 Mt at 0.65 g/t AuEq for an additional 4.16 Moz AuEq

- Estimated gold equivalent ounces in the indicated category have increased by approximately 117% compared to the 2022 MRE*

- The MRE was constrained using a series of conceptual pit design shells for the Whistler deposit, which assumed a first phase with an estimated 22.4 Mt of mineralized material at a grade of 1.04 g/t AuEq and a strip ratio of 0.08:1 (waste:ore)

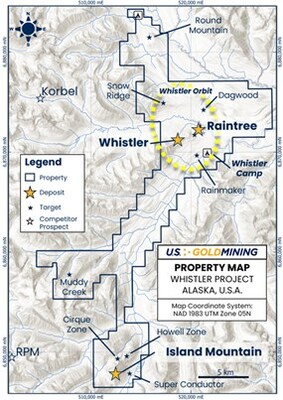

- The three Au-Cu-Ag porphyry deposits comprised within the Whistler MRE - Whistler, Raintree and Island Mountain - occupy approximately 1% of the Company's land holdings and occur within a cluster of high priority targets sharing key geological characteristics with the known deposits, thereby highlighting the broader exploration potential of the Project

- The Company is currently systematically exploring nearby targets within the 'Whistler Orbit' where an additional 12 potential targets remain under-explored

- The 2024 Whistler MRE encompasses 2023 drilling as reported earlier this year (see news release January 16, 2024), including the initial intercept contained within WH23-03 which comprised 547 m at 1.06 g/t AuEq

- It does not include recently reported confirmatory assays from the re-entry of WH23-01 drilled in 2024 (see announcement September 30, 2024) and which included the extension of the mineralized intercept to 652.5m at 1.00 g/t AuEq

- The 2024 core drilling program has now concluded, achieving 4,006 meters of drilling in 6 holes.

Tim Smith, Chief Executive Officer of U.S. GoldMining, commented: "In less than one-and-a-half years since completing our initial public offering, U.S. GoldMining's exploration initiatives have resulted in strengthened confidence in the mineral resource estimate for its flagship Whistler Deposit by increasing estimated gold equivalent ounces in the indicated category by 117% from prior estimates. The Project now contains 6.5 Moz AuEq in the indicated resource category and an additional 4.2 Moz AuEq in the inferred resource category. The successful 2023 drilling program at Whistler improved our confidence in the proximity of mineralization close to surface, extended mineralization along strike to the south, confirmed the consistency of mineralization within the high-grade core of the deposit and grew the overall resource primarily by the drill bit.

Since the mineral resource estimate was updated, additional results of the 2024 program have been received including the extension of the WH23-03 mineralized intercept to 652.5m at 1.00 g/t AuEq, further confirming the continuity of mineralization within the high-grade core. Our recently completed 2024 drilling program within the Whistler deposit further confirmed the geological model while drill testing below the current mineral resource block model for additional potential extensions of the mineral system. We look forward to receiving additional results from the 2024 drill hole assays which we believe will continue to support the Project's potential to host a long-life, high-quality gold-copper-silver mine located in one of the most favorable mining jurisdictions in the United States."

Updated Mineral Resource Estimate Overview

The MRE was based on 43,096 meters of drill data available as of January 16, 2024, (refer to the Company's news release dated January 16, 2024, for further details), prior to the commencement of the Company's ongoing 2024 drill campaign. The author of the report conducted a site visit August 6, 2024, which included collection of independent duplicate samples for umpire laboratory analysis. The Effective Date for the updated MRE is September 12, 2024. The MRE is constrained within a revenue factor 1.5 pit shell and reported above a US$10/tonne cut-off value (equivalent to 0.27 g/t AuEq cut-off grade).

The October 2024 updated Whistler MRE incorporates:

- Revised mineral resource reporting at US$10/tonne cut-off (previously the 2022 MRE was reported at US$10.50/t) and using below 3-year trailing average commodity assumptions of US$1,850/oz Au, US$4.00/lb Cu and US$23/oz Ag, across all three Project deposits: Whistler, Raintree and Island Mountain (see Figure 1).

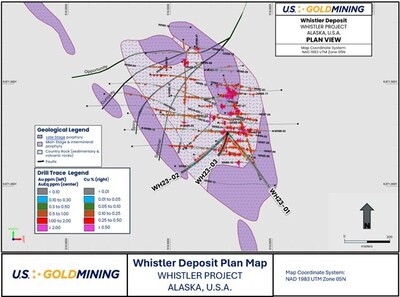

- The addition of three 2023 diamond core drill holes for 1,674 meters of drilling within the namesake Whistler Deposit (see Figure 2), with revisions to the geological interpretation and three dimensional mineralization modelling.

The following table sets forth a summary of the Whistler 2024 MRE update.

Table 1: Mineral Resource Estimate for the Total Whistler Project (Effective date: September 12, 2024)

Class | Deposit | Cut-off | ROM | In situ Grades | In situ Metal | |||||||

(US$/t) | (ktonnes) | NSR | AuEqv | Au | Cu | Ag | AuEqv | Au | Cu | Ag | ||

Indicated | Whistler Pit | 10 | 282,205 | 22.84 | 0.68 | 0.41 | 0.16 | 1.89 | 6,201 | 3,724 | 999 | 17,166 |

Raintree Pit | 10 | 8,905 | 21.08 | 0.63 | 0.46 | 0.08 | 4.81 | 180 | 131 | 16 | 1,378 | |

Indicated Open Pit | varies | 291,410 | 22.79 | 0.68 | 0.41 | 0.16 | 1.98 | 6,381 | 3,855 | 1,015 | 18,544 | |

Raintree UG | 25 | 3,064 | 34.41 | 1.03 | 0.79 | 0.13 | 4.49 | 101 | 78 | 9 | 443 | |

Total Indicated | varies | 294,474 | 22.91 | 0.68 | 0.42 | 0.16 | 2.01 | 6,482 | 3,933 | 1,024 | 18,987 | |

Inferred | Whistler Pit | 10 | 18,224 | 21.01 | 0.63 | 0.40 | 0.13 | 1.75 | 368 | 233 | 54 | 1,025 |

Island Mountain Pit | 10 | 124,529 | 18.21 | 0.54 | 0.45 | 0.05 | 1.02 | 2,180 | 1,817 | 139 | 4,084 | |

Raintree Pit | 10 | 15,056 | 23.12 | 0.69 | 0.55 | 0.06 | 4.36 | 335 | 267 | 21 | 2,112 | |

Inferred Open Pit | varies | 157,809 | 19.00 | 0.57 | 0.45 | 0.06 | 1.42 | 2,883 | 2,317 | 214 | 7,221 | |

Raintree UG | 25 | 40,432 | 32.81 | 0.98 | 0.76 | 0.12 | 3.31 | 1,275 | 994 | 103 | 4,300 | |

Total Inferred | varies | 198,241 | 21.82 | 0.65 | 0.52 | 0.07 | 1.81 | 4,158 | 3,311 | 317 | 11,521 | |

Notes to Table 1:

1. | Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. |

2. | Inferred mineral resources are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. |

3. | The Mineral Resource Estimate for the Whistler, Island Mountain, and the upper portions of the Raintree West deposits have been confined by an open pit with "reasonable prospects of economic extraction" using the following assumptions: |

• Metal prices of US$1,850/oz Au, US$4.00/lb Cu and US$23/oz Ag; | |

• Payable metal of 95% payable for Au and Ag, and 96.5% payable for Cu | |

• Refining costs for Au of US$8.00/oz, for Ag of US$0.60/oz and for Cu of US$0.05/lb. | |

• Offsite costs for Au of US$77.50/wmt, for Ag of US$3.50/wmt and for Cu of US$55.00/wmt. | |

• Royalty of 3% NSR; | |

• Pit slopes are 50 degrees; | |

• Mining cost of US$2.25/t for waste and mineralized material; and | |

• Processing, general and administrative costs of US$7.90/t. | |

4. | The lower portion of the Raintree West deposit has been constrained by a mineable shape with "reasonable prospects of eventual economic extraction" using a US$25.00/t cut-off. |

5. | Metallurgical recoveries are: 70% for Au, 83% for Cu, and 65% Ag for Ag grades below 10g/t. The Ag recovery is 0% for values above 10g/t for all deposits. |

6. | The NSR equations are: below 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$54.646/t) + (Cu*83%*US$3.702*2204.62 + Ag*65%*US$0.664)), and above 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$56.646g/t) + (Cu*83%*US$3.702*2204.62)) |

7. | The Au Equivalent equations are: below 10g/t Ag: AuEq=Au + Cu*1.771 +0.0113Ag, and above 10g/t Ag: AuEq=Au + Cu*1.771 |

8. | The specific gravity for each deposit and domain ranges from 2.76 to 2.91 for Island Mountain, 2.60 to 2.72 for Whistler with an average value of 2.80 for Raintree West. |

9. | The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). |

10. | Numbers may not add due to rounding. |

Additional details of the mineral resource estimate are set forth in the S-K 1300 Report titled "S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project", Effective Date 12 September 2024 and Date of Issue 7 October 20204, a copy of which is available under the Company's profile at www.sec.gov. The Company plans to file a Canadian National Instrument 43-101 ("NI 43-101") technical report within 45 days of the date hereof.

*For comparison, the previous 2022 MRE (Effective Date September 22, 2022) comprised 118 Mt at 0.79 g/t AuEq for 2.99 Moz AuEq Indicated resources, and 317 Mt at 0.63 g/t Au for 6.45 Moz AuEq Inferred resources, at a US$10.50/t cutoff value for open pit resources and US$25/t for underground resources.

Whistler Project High-Grade Core

The updated 2024 Whistler MRE is underpinned by a significant component of higher-grade mineralization within the core of the three deposits. Table 2 illustrates the MRE at a range of cut-offs which provide optionality for potential future mine development scenarios. For example, using an elevated cut-off value of US$20/t (equivalent to 0.37 g/t AuEq cut-off grade) for open pit resources, the MRE contains a robust higher grade subset resource of:

- 134 Mt at 0.98 g/t AuEq for 4.2 Moz AuEq Indicated (includes Raintree UG resource)

- 87 Mt at 0.96 g/t AuEq for 2.7 Moz AuEq Inferred (includes Raintree UG resource)

Class | Source | Cutoff | ROM | In situ Grades | In situ metal | |||||||

(US$/t) | (ktonnes) | NSR | AuEqv | Au | Cu | Ag | AuEqv | Au | Cu | Ag | ||

Indicated | Open Pit | 6 | 333,200 | 20.98 | 0.63 | 0.37 | 0.15 | 1.99 | 6,717 | 3,999 | 1,088,419 | 20,822 |

7 | 327,336 | 21.24 | 0.63 | 0.38 | 0.15 | 1.99 | 6,680 | 3,983 | 1,080,877 | 20,541 | ||

7.9 | 319,301 | 21.59 | 0.65 | 0.39 | 0.15 | 1.99 | 6,623 | 3,958 | 1,068,264 | 20,024 | ||

10 | 291,410 | 22.79 | 0.68 | 0.41 | 0.16 | 1.99 | 6,381 | 3,855 | 1,015,095 | 18,544 | ||

15 | 206,236 | 27.03 | 0.81 | 0.51 | 0.18 | 1.99 | 5,356 | 3,382 | 798,024 | 13,449 | ||

20 | 131,449 | 32.55 | 0.97 | 0.65 | 0.19 | 2.08 | 4,111 | 2,728 | 561,495 | 8,809 | ||

25 | 85,710 | 38.03 | 1.14 | 0.79 | 0.21 | 2.18 | 3,132 | 2,166 | 393,659 | 5,985 | ||

30 | 57,629 | 43.30 | 1.29 | 0.92 | 0.22 | 2.27 | 2,397 | 1,706 | 281,879 | 4,184 | ||

Underground | 25 | 3,064 | 34.41 | 1.03 | 0.79 | 0.13 | 4.49 | 101 | 78 | 8,613 | 443 | |

Total | varies | 294,474 | 22.91 | 0.68 | 0.42 | 0.16 | 2.02 | 6,482 | 3,933 | 1,023,708 | 18,987 | |

Inferred | Open Pit | 6 | 247,250 | 14.99 | 0.45 | 0.36 | 0.05 | 1.24 | 3,563 | 2,827 | 276,142 | 9,874 |

7 | 222,529 | 15.94 | 0.48 | 0.38 | 0.05 | 1.28 | 3,408 | 2,718 | 260,061 | 9,168 | ||

7.9 | 202,534 | 16.78 | 0.50 | 0.40 | 0.06 | 1.31 | 3,267 | 2,614 | 245,757 | 8,536 | ||

10 | 157,809 | 19.00 | 0.57 | 0.45 | 0.06 | 1.43 | 2,883 | 2,317 | 213,970 | 7,221 | ||

15 | 83,445 | 24.97 | 0.75 | 0.60 | 0.08 | 1.74 | 2,003 | 1,611 | 149,376 | 4,638 | ||

20 | 46,184 | 31.30 | 0.94 | 0.76 | 0.10 | 1.98 | 1,389 | 1,129 | 99,917 | 2,923 | ||

25 | 28,112 | 37.12 | 1.11 | 0.91 | 0.11 | 2.19 | 1,003 | 827 | 68,000 | 1,983 | ||

30 | 16,408 | 44.16 | 1.32 | 1.11 | 0.12 | 2.35 | 696 | 590 | 41,316 | 1,242 | ||

Underground | 25 | 40,432 | 32.81 | 0.98 | 0.76 | 0.12 | 3.31 | 1,275 | 994 | 102,953 | 4,300 | |

Total | varies | 198,241 | 21.82 | 0.65 | 0.52 | 0.07 | 1.81 | 4,158 | 3,311 | 316,923 | 11,521 | |

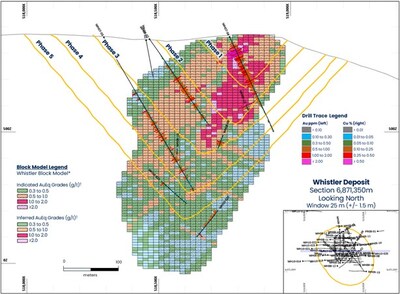

In particular, the flagship Whistler Deposit contains a high-grade core defined by coincident approximately ≥0.40 g/t gold and ≥0.20% Cu grade contours that extend approximately 500 m in the north-south dimension, 250 m in the east-west dimension and extend to 600 m depth (from surface), where it remains open down dip. The Whistler Deposit high-grade core offers the option to consider low strip ratio, higher – grade starter-pit scenarios. Table 3 provides an incremental breakdown of the Whistler Deposit MRE as contained within sequentially expanding pit shells which are illustrated in Figure 3.

PIT PHASE | CLASS | Mineralized | NSR | AuEQ | Au | Cu | Ag | In Situ | Waste | Strip Ratio |

(ktonnes) | (US$/tonne) | (g/t) | (g/t) | ( %) | (g/t) | (AuEq koz) | (ktonnes) | Waste:Minz | ||

PHASE 1 | Indicated | 22,425 | 34.81 | 1.04 | 0.65 | 0.23 | 2.30 | 750 | 1,776 | 0.08 |

Inferred | - | - | - | - | - | - | --- | |||

PHASE 2 | Indicated | 42,703 | 29.4 | 0.88 | 0.56 | 0.19 | 2.00 | 1,206 | 17,684 | 0.41 |

Inferred | 910 | 16.28 | 0.49 | 0.26 | 0.13 | 2.00 | 14 | |||

PHASE 3 | Indicated | 106,892 | 23.71 | 0.71 | 0.43 | 0.16 | 1.80 | 2,435 | 117,922 | 1.04 |

Inferred | 6,722 | 22.39 | 0.67 | 0.44 | 0.14 | 1.70 | 145 | |||

PHASE 4 | Indicated | 69,425 | 17.61 | 0.53 | 0.29 | 0.14 | 1.80 | 1,175 | 145,808 | 1.96 |

Inferred | 4,944 | 19.81 | 0.59 | 0.36 | 0.14 | 1.60 | 94 | |||

PHASE 5 | Indicated | 41,061 | 16.08 | 0.48 | 0.257 | 0.13 | 1.8 | 634 | 238,127 | 5.10 |

Inferred | 5,648 | 21.18 | 0.633 | 0.409 | 0.13 | 1.9 | 115 | |||

Total Indicated | 282,506 | 22.84 | 0.68 | 0.41 | 0.16 | 1.87 | 6,201 | 521,317 | 1.73 | |

Total Inferred | 18,224 | 21.01 | 0.63 | 0.40 | 0.13 | 1.75 | 368 | |||

Whistler Project Geology

The Whistler Deposit is hosted within the Whistler Intrusive Suite (see Figure 2), a composite suite of diorite stocks and dykes with cross-cutting relationships that divide the suite broadly into an early Main Stage Porphyry ("MSP"), a later cross-cutting Intermineral Porphyry Suite ("IMP") and the latest cross-cutting intrusive phase referred to as the Late Stage Porphyry ("LSP"). Gold and copper mineralization is characterized by presence of disseminated sulphide and quartz + sulphide vein stockworks (including classic porphyry diagnostic 'A', 'B', 'D', and 'M' type veins), and potassic alteration which is variably overprinted by later phyllic alteration. The early-stage MSP suite is most strongly altered, veined and mineralized, with the IMP being less intensely altered and veined but remaining consistently mineralized, and the late or post-mineralization LSP generally being below cutoff grade or unmineralized. The 'high-grade core' correlates with intense potassic alteration and highest frequency of A and B veining within the MSP.

Based on re-logging of historical drill core in conjunction with the 2023 drilling program, the Whistler Deposit three-dimensional geological model was re-interpreted to include adjustments to geometry, extents and continuity of the MSP, IMP and LSP suites. These were used as a guide to create mineralization shells for both Au-Ag and Cu separately. The shells include a higher grade 'core', with lower grade shells also generated to constrain both Au-Ag and Cu mineralization. A significant change in the 2024 geological model is the removal of the 'Divide Fault', which defined a hard boundary between geological and geostatistical domains in previous iterations of the Whistler deposit model. Relogging and 2023 drilling has confirmed there is no compelling evidence for this fault, thus the previously modelled Divide Fault is no longer seen to influence the mineralization. Subsequently, gold and copper grade shells have been constructed to constrain the Whistler Deposit mineral block model, honoring the geological boundaries defined by the limits of the productive MSP and ISP, and taking into account the weakly to non-mineralized LSP.

Mineralization at Raintree West occurs as two main types: 1) porphyry-style gold-copper mineralization hosted by diorite porphyry stocks and consisting of quartz and magnetite stockwork veining, with vein and disseminated chalcopyrite associated with potassic alteration, and 2) later cross-cutting silver-gold-lead-zinc mineralization in quartz-carbonate veins with occasional banded epithermal-like textures. The early gold-copper mineralization is best developed within, and controlled by, early diorite porphyry intrusions (akin to MSP at the Whistler Deposit), whereas the later silver-gold-lead-zinc veins surround and locally overprint the porphyry mineralization and are most abundant in the host andesitic composition volcanic.

The Island Mountain deposit, located 20 km south of the Whistler-Raintree deposits, is comprised of a suite of nested intrusions, ranging compositionally from hornblende diorite to hornblende-biotite monzonite, with mineralization occurring predominantly within the 'Breccia Zone', comprising intrusive breccias occurring as sub-vertical 100-150 m diameter 'pipes' with pyrrhotite-pyrite-chalcopyrite mineralization, that host the bulk of gold-copper porphyry mineralization.

Visit www.usgoldmining.us for more information, including high resolution figures and Technical Reports.

Technical Information

The disclosure herein, including relating to mineral resource estimates, has been prepared in accordance with the requirements of Canadian securities laws, as set forth in NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") classification system, the CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, and in accordance with the requirements found in S-K 1300.

The technical work of the 2024 Whistler Project MRE was completed by Sue Bird, P.Eng., of Moose Mountain Technical Services ("MMTS"), an independent qualified person as defined by NI 43-101 and S-K-1300. Sue Bird has reviewed, verified and approved the technical information related to the MRE in this news release.

Tim Smith, P.Geo., Chief Executive Officer of U.S. GoldMining, has supervised reviewed and approved the preparation of all other scientific and technical information contained herein. Mr. Smith is a qualified person as defined by NI 43-101 and S-K 1300.

About U.S. GoldMining Inc.

U.S. GoldMining Inc. is an exploration and development company focused on advancing the 100% owned Whistler Gold-Copper Project, located 105 miles (170 kilometers) northwest of Anchorage, Alaska, U.S.A. The Whistler Project consists of several gold-copper porphyry deposits and exploration targets within a large regional land package totaling approximately 53,700 acres (217.5 square kilometers).

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release constitutes "forward-looking statements" within the meaning of the United States federal securities laws and "forward-looking information" within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). Such statements include statements with regard to the Company's expectations regarding the Project and its future plans regarding the Project. Words such as "expects", "anticipates", "plans", estimates" and "intends" or similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on U.S. GoldMining's current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, variations in the underlying assumptions associated with the estimation or realization of mineral resources, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Many of these factors are beyond the Company's ability to control or predict. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the prospectus filed with the applicable Canadian regulatory authorities and with the U.S. Securities and Exchange Commission (the "SEC") in connection with the initial public offering, as well as other filings made by the Company with the SEC at www.sec.gov and the applicable Canadian regulatory authorities at www.sedarplus.ca. Forward-looking statements contained in this news release are made as of this date, and U.S. GoldMining does not undertake any duty to update such information except as required under applicable law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/us-goldmining-more-than-doubles-indicated-mineral-resource-estimate-to-6-48-million-aueq-oz-with-an-additional-4-16-million-aueq-oz-inferred-for-the-whistler-project-alaska-302268810.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/us-goldmining-more-than-doubles-indicated-mineral-resource-estimate-to-6-48-million-aueq-oz-with-an-additional-4-16-million-aueq-oz-inferred-for-the-whistler-project-alaska-302268810.html

SOURCE U.S. GoldMining Inc.

Ausgewählte Hebelprodukte auf U.S.GoldMining

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf U.S.GoldMining

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Nachrichten zu U.S.GoldMining Inc Registered Shs

Keine Nachrichten im Zeitraum eines Jahres in dieser Kategorie verfügbar.

Eventuell finden Sie Nachrichten, die älter als ein Jahr sind, im Archiv

Analysen zu U.S.GoldMining Inc Registered Shs

Keine Analysen gefunden.