F&G's Fifth Annual Risk Tolerance Tracker Finds Inflation, U.S. Presidential Election and Cyberfraud Top of Mind for American Investors

Werte in diesem Artikel

DES MOINES, Iowa, Oct. 16, 2024 /PRNewswire/ -- American investors1 are keeping a close eye on the economy and the nation's capital according to a new survey from F&G Annuities & Life, Inc. (NYSE: FG) (F&G), a leading provider of insurance solutions serving retail annuity and life customers and institutional clients. F&G's fifth annual Risk Tolerance Tracker asked American investors how the events of the past 12 months have impacted their views on retirement and risk, as well as the issues they are concerned about for the year ahead.

Inflation continues to rank as the top stressor, with 80% of respondents saying they are worried about it having a negative impact on their financial future. This was followed closely by worries about the U.S presidential election, which were cited by nearly three quarters (72%) of American investors. More specifically, nearly half (48%) said they expect the presidential election to have an impact on their retirement plans.

Worries about a recession are also top of mind at 72%. Additionally, cybercrime/fraud (63%), geopolitical risks/tensions (61%), historically high debt (59%), stock market volatility (59%) and the impact of Generative AI on finances (50%) are other leading concerns when people evaluate factors impacting their financial future.

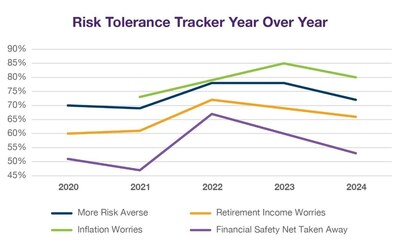

Americans' Risk Tolerance Over Time

When it comes to how American investors see overall risk tolerance and the mindset around their financial future, there are some signs of improvement, although many fears remain.

- 73% of respondents say the events of the last 12 months made them less likely to take financial risks. This is down from the past two years when 78% of respondents said they had become more financially risk averse.

- Worries about retirement income still persist as 66% are worried about retirement income due to the events of the last 12 months, down only 3% from 2023.

- Fewer people (53%) feel like their financial safety net was ripped away as a result of the past 12 months compared to 60% in 2023 and 67% in 2022.

The Generational Risk Gap

When it comes to how different generations view risk, Baby Boomers are the most worried about the U.S. presidential election having a negative impact on their financial future (79%), compared to Generation X (72%) and Millennials (64%).

Meanwhile, GenX respondents are most worried about the U.S. entering a recession (76%), compared to Millennials (72%) and Baby Boomers (69%).

All generations continue to cite inflation as the top worry that may affect their financial future.

Despite this, well over half (58%) of respondents stated that they don't currently use a financial professional. More concerning is that the two generations that are either in or approaching retirement may not be getting appropriate advice. Over half of Baby Boomers surveyed (53%) and nearly two-thirds of GenX (63%) don't use a financial professional.

The Opportunity for Guaranteed Income Products

In addition to overlooking advice, American investors are also overlooking guaranteed income products as a way to hedge these unpredictable times as only 14% of respondents noted owning an annuity.

When asked about how important various factors were when considering their investments for retirement income,2 88% noted guaranteed income for life as important just behind maximizing their accumulated income (91%).

"Our fifth annual survey shows that while risk tolerance is modestly increasing, uncertain economic factors continue to weigh on the minds of American investors," said Chris Blunt, CEO of F&G. "Yet at the same time, many investors are not taking advantage of the tools they need to plan for the long term, such as leveraging an advisor and building a balanced portfolio that includes guaranteed income products. Being proactive now can give investors more peace of mind in the months and years to come."

For more information on F&G's latest survey, please visit fglife.com/research

Survey Methodology

The survey was conducted online by ROI Rocket, a MarketOnce company and an industry leader in consumer and B2B research. It was fielded from August 22 to September 9, 2024 among a nationally representative sample of 1,678 U.S. adults 30 years of age and older who have sole or shared financial decision-making responsibility for their household, and own financial products valued at $10,000 or more.

About F&G

F&G Annuities & Life, Inc. is committed to helping Americans turn their aspirations into reality. F&G is a leading provider of insurance solutions serving retail annuity and life customers and institutional clients and is headquartered in Des Moines, Iowa. For more information, please visit fglife.com.

Media Contact

Gabrielle Simon

pro-F&G@prosek.com

413.695.3818

Investors Contact:

Lisa Foxworthy-Parker

SVP of Investor & External Relations

515.330.3307

Investor.relations@fglife.com

1 Survey fielded among a nationally representative sample of 1,678 U.S. adults 30 years of age and older who have sole or shared financial decision-making responsibility for their household, and own financial products valued at $10,000 or more.

2 This question fielded among adults ages 45+

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fgs-fifth-annual-risk-tolerance-tracker-finds-inflation-us-presidential-election-and-cyberfraud-top-of-mind-for-american-investors-302276866.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fgs-fifth-annual-risk-tolerance-tracker-finds-inflation-us-presidential-election-and-cyberfraud-top-of-mind-for-american-investors-302276866.html

SOURCE F&G Annuities & Life, Inc.

Ausgewählte Hebelprodukte auf F&G Annuities Life

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf F&G Annuities Life

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Nachrichten zu F&G Annuities & Life Inc Registered Shs When Issued

Analysen zu F&G Annuities & Life Inc Registered Shs When Issued

Keine Analysen gefunden.